Diversification: It's All About (Asset) Class - November 2021

If one were to poll investors and investment professionals to determine their ideal investment outcome, the vast majority would no doubt agree: it is a double-digit total return in all economic environments, each and every year.

Naturally, they would also agree that the worst-case scenario is an overall decrease in asset value. But despite this knowledge, very few achieve this desired outcome; and many, indeed, encounter the worst-case scenario—losses. The reasons for this are diverse: misallocation of assets, pseudo-diversification, hidden correlation, weighting imbalance, false returns, and underlying devaluation.

KEY TAKEAWAYS

- A high correlation exists between the returns investors achieve on their holdings and the underlying asset class performance of those holdings

- True portfolio diversification is achieved through selecting and holding a variety of asset classes, rather than individual stock-picking and market-timing

- Ideal asset allocation is not static. Assets' performance and their correlations to each other change, so monitoring and realignment are imperative

- Effective diversification will include asset classes of varying risk profiles held in various currencies

The Importance of Asset Class Allocation

Most investors, including investment professionals and industry leaders, do not beat the index of the asset class in which they invest, according to two studies by Gary P. Brinson and Gilbert L. Beebower titled "Determinants of Portfolio Performance" (1986) (with L. Randolph Hood) and "Determinants of Portfolio Performance II: An Update" (1991) (with Brian D. Singer). This conclusion is also backed up by a third study by Roger G. Ibbotson and Paul Kaplan titled "Does Asset Allocation Policy Explain 40%, 90% or 100% of Performance?" (2001).

A more recent review of the topic, published in 2020, affirms the benefits of portfolio diversification, focusing on four core principles (the law of large numbers, correlation, the capital asset pricing model, and risk parity) in light of the 2009 financial crisis and subsequent bull market run.

This underperformance phenomenon begs the question: if a U.S. equities growth fund does not consistently equal or beat the Russell 3000 Growth Index, what value has the investment management added to justify their fees? Perhaps simply buying the index would be more beneficial.

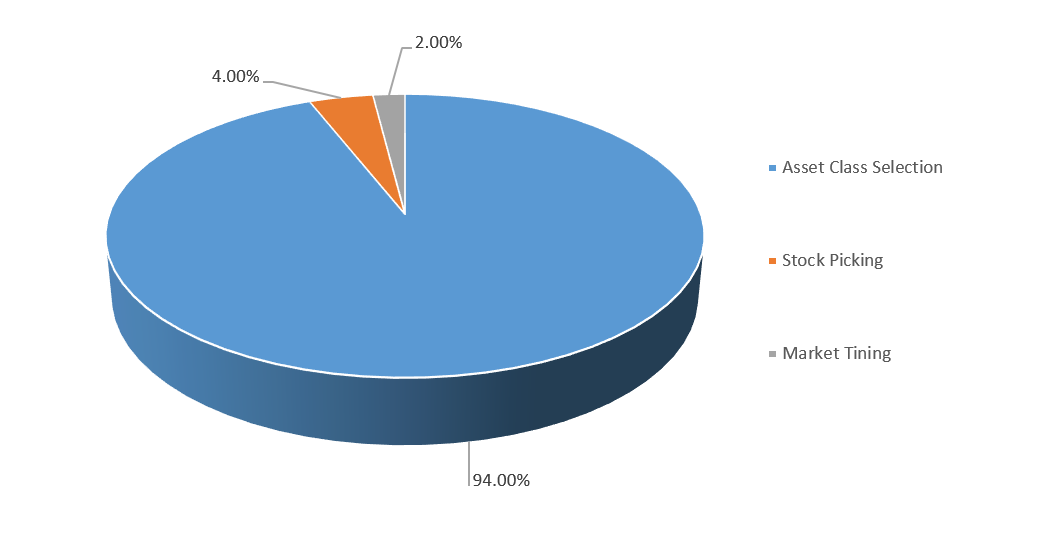

Furthermore, the studies show a high correlation between the returns investors achieve and the underlying asset class performance. For example, a U.S. bond fund or portfolio will generally perform much like the Lehman Aggregate Bond Index, increasing and decreasing in tandem. This shows that, as returns can be expected to mimic their asset class, asset class selection is far more important than both market timing and individual asset selection. Brinson and Beebower concluded that market timing and individual asset selection accounted for only 6% of the variation in returns, with strategy or asset class making up the balance.

[1] Gary P. Brinson, L. Hood, G. L. Beebower, "Determinants of Portfolio Performance", 1986

[2] Gary P. Brinson, Brian D. Singer and Gilbert L. Beebower, "Determinants of Portfolio Performance II: An Update", 1991