Our Fees

Initial Consultation

The initial consultation is at our cost. The meeting will establish whether you feel it would be worthwhile engaging with us.

We can then examine your financial objectives and goals and agree on the most suitable way to achieve these. We will go through the costs of our service in detail and what you can expect in return.

Ongoing Service

If you decide to proceed with the relationship, you can expect the following from us in terms of the service we provide:

- Preparation of a financial plan

- Implementation of the plan

- Annual review meetings

- Ongoing administration, planning and advice

- Tax efficient investing and retirement planning

- Cashflow Modelling

- Online account access

Initial Charges

Our initial charge typically ranges from 1% and 3% of the value of the account, depending on the size and complexity of the work involved. This would always be agreed in advance with you before any work is undertaken.

We would not usually make a further initial charge for investing additional monies into your account.

Ongoing Charges

We apply an ongoing charge in return for managing your money. A full list of services will be provided in our formal agreement with you.

Our ongoing charge is percentage based and in most cases will be deducted directly by the investment manager from your portfolio on a monthly basis. Therefore, this will not need to be paid personally.

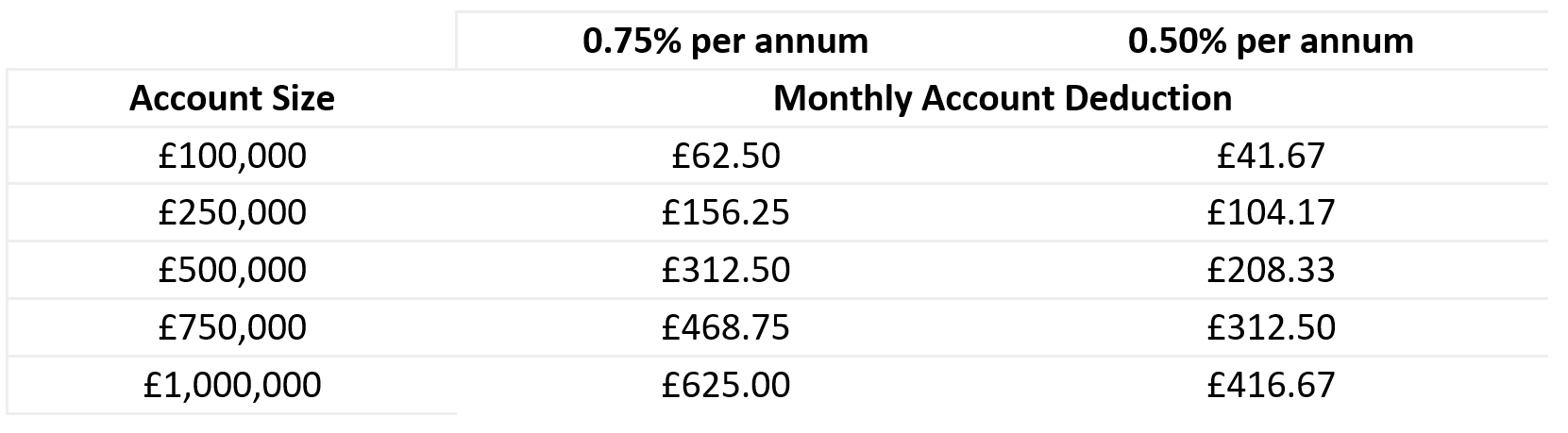

The ongoing charge is between 0.50% and 1% of the account value per annum, subject to discussion with the adviser.

The table below provides an example of the level of the most common ongoing charges for portfolios of varying sizes:

Hourly Fees

Where appropriate and for certain types of advice, we can charge an hourly rate. For example, this could involve work on a corporate pension scheme such as a SSAS.